Case-Shiller: National House Price Index increased 4.1% year-over-year in March

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Accelerate, Led by San Francisco and Denver According to the S&P/Case-Shiller Home Price Indices

Click on graph for larger image.

Click on graph for larger image.

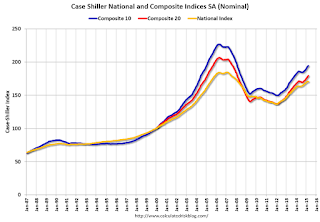

The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.2% from the peak, and up 0.9% in March (SA).

The Composite 20 index is off 13.1% from the peak, and up 0.9% (SA) in March.

The National index is off 7.6% from the peak, and up 0.1% (SA) in March. The National index is up 24.7% from the post-bubble low set in December 2011 (SA).

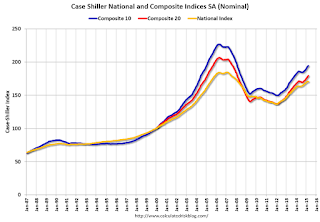

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.

The Composite 10 SA is up 4.7% compared to March 2014.

The Composite 20 SA is up 5.0% year-over-year..

The National index SA is up 4.1% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in March seasonally adjusted. (Prices increased in 19 of the 20 cities NSA) Prices in Las Vegas are off 40.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 50% above January 2000 (50% nominal gain in 15 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 10% above the change in overall prices due to inflation.

Two cities - Denver (up 65% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston and, Charlotte). Detroit prices are still below the January 2000 level.

This was close to the consensus forecast. I'll have more on house prices later.

from Calculated Risk http://www.calculatedriskblog.com/2015/05/case-shiller-national-house-price-index.html

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Accelerate, Led by San Francisco and Denver According to the S&P/Case-Shiller Home Price Indices

Data released today for March 2015 show that home prices continued their rise across the country over the last 12 months. ... Both the 10-City and 20-City Composites saw year-over-year increases in March. The 10-City Composite gained 4.7% year-over-year, while the 20-City Composite gained 5.0% year-over-year. The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.1% annual gain in March 2015 versus a 4.2% increase in February 2015.

...

The National index increased again in March with a 0.8% increase for the month. Both the 10- and 20-City Composites increased significantly, reporting 0.8% and 0.9% month-over-month increases, respectively. Of the 19 cities reporting increases, San Francisco led all cities with an increase of 3.0%. Seattle followed next with a reported increase of 2.3%. Cleveland reported an increase of 0.4%, its first positive month-over-month increase since August 2014. New York was the only city to report a negative month-over-month change with a -0.1% decrease for March 2015.

...

“Home prices have enjoyed year-over-year gains for 35 consecutive months,” says David M. Blitzer, Managing Director & Chairman of the Index Committee for S&P Dow Jones Indices. “The pattern of consistent gains is national and seen across all 20 cities covered by the S&P/Case-Shiller Home Price Indices. The longest run of gains is in Detroit at 45 months, the shortest is New York with 27 months. However, the pace has moderated in the last year; from August 2013 to February 2014, the national index gained more than 10% year-over-year, compared to 4.1% in this release.

“Given the long stretch of strong reports, it is no surprise that people are asking if we’re in a new home price bubble. The only way you can be sure of a bubble is looking back after it’s over. The average 12 month rise in inflation adjusted home prices since 1975 is about 1.0% per year compared to the current 4.1% pace, arguing for a bubble. However, the annual rate of increase halved in the last year, as shown in the first chart. Home prices are currently rising more quickly than either per capita personal income (3.1%) or wages (2.2%), narrowing the pool of future home-buyers. All of this suggests that some future moderation in home prices gains is likely. Moreover, consumer debt levels seem to be manageable. I would describe this as a rebound in home prices, not bubble and not a reason to be fearful.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.2% from the peak, and up 0.9% in March (SA).

The Composite 20 index is off 13.1% from the peak, and up 0.9% (SA) in March.

The National index is off 7.6% from the peak, and up 0.1% (SA) in March. The National index is up 24.7% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to March 2014.

The Composite 20 SA is up 5.0% year-over-year..

The National index SA is up 4.1% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in March seasonally adjusted. (Prices increased in 19 of the 20 cities NSA) Prices in Las Vegas are off 40.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 50% above January 2000 (50% nominal gain in 15 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 10% above the change in overall prices due to inflation.

Two cities - Denver (up 65% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston and, Charlotte). Detroit prices are still below the January 2000 level.

This was close to the consensus forecast. I'll have more on house prices later.

from Calculated Risk http://www.calculatedriskblog.com/2015/05/case-shiller-national-house-price-index.html

Post a Comment